ACE Scholarships (ACE) provides more than 1,500 scholarships to economically disadvantaged students attending 147 K-12 partner private schools within the state of Louisiana. COVID-19 and the shutdown of schools and businesses have impacted these greatly. We surveyed 1226 Louisiana ACE families to get a better sense of how families are dealing with and how they are coping with this extraordinary crisis. Three hundred thirty-four families responded to the survey giving us a response rate of 27.2 percent.

Key Findings:

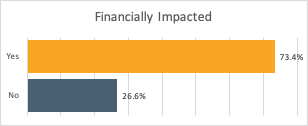

A majority of families have been financially impacted with loss of jobs, reduced hours, or the need to stay home due to their children’s school being shut down.

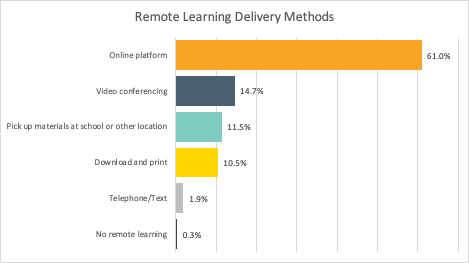

Due to the school shutdowns, schools have unexpectedly had to find ways to facilitate distance learning. Nearly 75 percent of ACE partner schools deliver via online and video conference platforms. However, not all schools have relied on the internet for lessons and instruction. Some have allowed families to pick up hard-copy materials, and others have used calling or texting to get coursework to students.

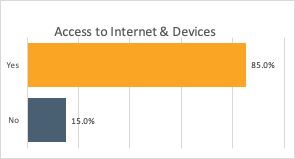

While most families have been able to cope with a predominantly online approach to school, 15 percent of low-income ACE students have had to cope with substantial barriers that can inhibit their access to learning.

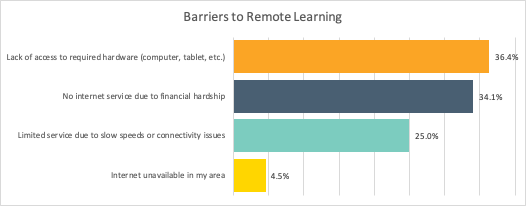

For the families that faced access barriers to online remote learning, the main issues are the lack of high-speed broadband internet or the lack of computer devices. Nearly four out of every 10 students lack access to a computer, tablet, or device needed to online learning. More than six in 10 students either do not have internet available in their area, cannot afford broadband internet service, or have slow internet and connectivity issues.

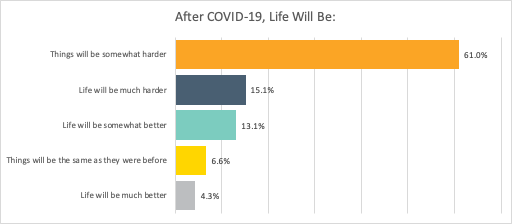

Looking to the future, families shared their concern that life is not going to return to normal anytime soon. Economically disadvantaged families know the difficulties of living paycheck to paycheck. When their paycheck stops it hits them harder than most due to a lack of savings. This puts them further behind making a longer road to recovery. ACE families, in particular, are acutely aware of the sacrifices they must make to get their child in a better and safer education environment. These financial sacrifices will be even harder due to the expected long-term nature and probability of the COVID-19 return this fall.

In addition to gathering statistical data, the survey ask two qualitative, open-ended questions:

- How has COVID-19 and the related closures affected your life, family situation and learning experience for your children?

- Have you or your school undertaken any efforts to serve your community during this time of crisis?

The answers to these questions provided a deeper insight into the effects of COVID-19 on families’ physical and mental state. Using a number of oft-repeated key words, we were able to identify a general theme in these often very personal responses: Although there is much anxiety, fear, and worry about the immediate future, families are using this time to build closer family bonds and help others.

Some of the frequent words used in their responses were as follows:

| Adjusting | Afraid | Anxious | Checking on others |

| Coming together | Depressed | Difficult | Encouraging others |

| Family bonding | Financial worry | Helping | Hopeful |

| Scared | Stressed | Students falling behind | Looking out for others |

| Lack motivation | Missing family | Missing friends | Missing school |

| Overwhelmed | Sorrow (loss of loved ones) | Struggling with learning | Thankful |

| Worried about family | Worried about not being able to afford to return to their school this fall | ||

Even though a large majority of ACE families have been financially impacted, they are still finding ways to be connected with their communities and assist others. Here are the most common ways families are helping others:

- Baking for neighbors

- Chalking encouraging sidewalk messages for neighbors

- Donating blood

- Making encouraging videos of acts of kindness around their town to share on social media

- Making masks and donating to those on the front lines and others who need them

- Making signs and placing them in yards thanking healthcare workers

- Printing out school lessons for others

- Running errands for neighbors (groceries, medicines, taking them to appointments, etc.)

- Writing notes to healthcare workers, family, and the elderly

Schools and communities are also finding ways to serve their neediest students through this crisis. Below are the most common methods students and families are being helped.

- Food boxes and meals for those in need

- Offering devices to students who don’t have them

- Offering professional, psychological, and emotional support to those who need it

- Recording students thanking front line workers and distributing the video to those workers

- Serving food to healthcare workers

- Teachers are spending extra time helping students

- Working with nursing homes to assist the elderly

To review all the data, click here to review the full survey.

ACE is also conducting this survey in the seven other ACE states to discover how different communities are responding to COVID-19.