If you’re finding the whirlwind of information, materials, and requirements about the implementation of the federal Coronavirus Aid, Relief, and Economic Security (CARES) Act overwhelming, you aren’t alone! As one of the largest-scale pieces of legislation passed in American history, the CARES Act has created daunting challenges for state and federal agencies, local leaders, and policy groups alike.

The ACE team has been working for weeks to stay ahead of the CARES Act implementation curve, and we wanted to provide you with an update on several key programs affecting private schools.

GEER and ESSER Fund Equitable Services

New Federal Guidance on Equitable Services is a Huge Win

Yesterday, the United States Department of Education released federal guidance on precisely how state and local educational agencies must allocate CARES aid to private schools under the Governor’s Emergency Education Relief (GEER) Fund and Elementary and Secondary School Education Relief (ESSER) Fund. See this previous post for more information on these programs.

The guidance mirror recommendations that ACE has been pushing at a variety of levels for weeks, and it represents a huge win for private schools across the country. In short, this eight-page document preempts months or even years of fighting with education systems for fair treatment of private schools and families. And it spared thousands of private-school students from being shut out in the cold.

Here’s the short rundown of what the guidance says on the big questions:

- Every non-profit private school is eligible to receive aid, regardless of student residence in a Title I attendance area or previous participation in equitable services under existing Title programs.

- Every private school student is eligible to receive services provided with CARES aid, regardless of status as low income, at risk, or any other special category.

- State ed departments and school districts must start new notification and consultation processes to ensure that every private school has an opportunity to access these funds. Previously, many state ed departments were looking to force CARES aid into existing federal funding timelines, most of which have already closed for the year. That would have meant that hundreds of schools missed a train they didn’t even know was coming.

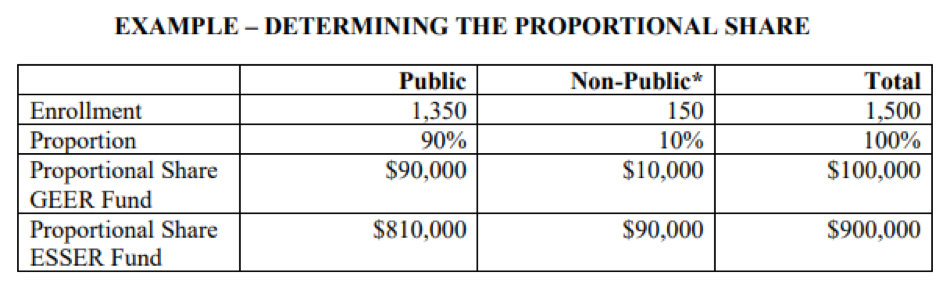

- Aid must be calculated using direct proportionality equations that factor in ALL private school students. This calculation will provide, by far, the largest possible per-pupil allocation of aid to private schools. See below for an example directly from the federal guidance:

*Non-public schools participating under the CARES Act programs.

What can schools and families do to ensure we receive the CARES aid to which we are legally entitled?

Here are some immediate action items we strongly recommend for all our partner schools nationwide:

1. Contact your private-school ombudsman. By federal law, every state must have one of these ombudsmen, who are responsible for advocating on behalf of private schools and ensuring that they receive federal aid to which they are due.

You can use our digital advocacy campaign to send a message to your state’s ombudsman in a matter of seconds. You can also look them up directly using this directory. They need to know you are counting on them to help your school!

2. Contact your local school district’s Title-funding office or superintendent. Ask them how they intend to approach equitable services for private schools in their districts and remind them that your school needs help. In particular, you will want to make sure that they are thinking through timelines, processes, and requirements that maximize access to this aid on the part of private schools.

Remember, every dollar you do not receive is another dollar the school district can spend on something else. As a result, these districts may not have a strong incentive to look out for your school’s best interests. You must be your own best advocate! We know this can be daunting, if you have any questions, feel free to reach out to us at policy@acescholarships.org.

3. Contact your state governor regarding his or her discretionary funds. Governors have wide latitude when it comes to allocating these funds, and private schools are entitled to receive “equitable services” from their school districts under this program if those school districts utilize funding for eligible purposes.

There are many, many groups competing for this funding. It is critical for your governor to hear from you about your school’s needs during this difficult time. If you haven’t already, you can use our digital advocacy campaign to contact your governor in a matter of seconds.

Other Grant Opportunities

Education Stabilization Fund Discretionary Grants

This week, the U.S. Dept. of Education announced yet another CARES Act aid program for K-12 schools. This one provides $307.5 million in discretionary grants. Of the total, $180 million is reserved for the Rethink K-12 School Models Grant and $127.5 million is reserved for the Reimagining Workforce Preparation Grant.

Grants given under the Rethink K-12 School Models Program can be used for the following purposes:

1. Microgrants for families, so that states can ensure they have access to the technology and educational services they need to advance their learning

2. Statewide virtual learning and course access programs, so that students will always be able to access a full range of subjects, even those not taught in the traditional or assigned setting

3. New, field-initiated models for providing remote education not yet imagined, to ensure that every child is learning and preparing for successful careers and lives

In particular, the microgrants provide a potential opportunity for private-school families to access much-needed tuition or other assistance. We strongly encourage you to contact your state private-school ombudsman and encourage him or her to advocate for the inclusion of private schools in any grant application filed under this program.

There are fewer details available about the Reimagining Workforce Preparation Grant Program as of this writing, but we will update this post with further information when we receive it. You can read more about both programs here.

USDA Distance Learning and Telemedicine Grants

The U.S. Department of Agriculture has extended the application window for funds under the Distance Learning and Telemedicine (DLT) Grant Program to July 13, 2020.

This lesser-known program is focused primarily on providing educational opportunities and access to medical services in rural communities. It is open to government agencies, businesses, and even nonprofits—which means many private schools may be eligible for funding. Grants can be used for the following purposes:

-

-

- Acquisition of eligible capital assets, such as:

-

- Broadband transmission facilities

- Audio, video and interactive video equipment

- Terminal and data terminal equipment

- Computer hardware, network components, and software

- Inside wiring and similar infrastructure that further DLT services

-

- Acquisition of instructional programming that is a capital asset

- Acquisition of technical assistance and instruction for using eligible equipment

- Acquisition of eligible capital assets, such as:

-

These grants require a 15-percent match on the part of the participant and are awarded via a competitive application process. You can read more about this program and find application instructions here.