ACE Scholarships (ACE) has undertaken several surveys to determine what partner schools and parents experienced due to the pandemic and subsequent remote learning. In addition, we looked forward to the upcoming fall school year to find out plans and needs.

Key findings on remote learning:

-

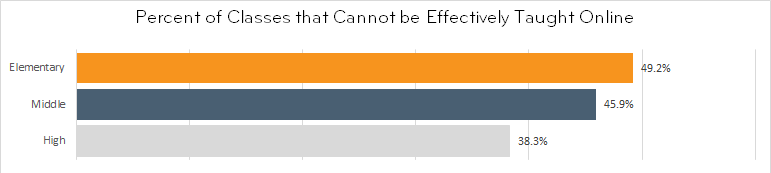

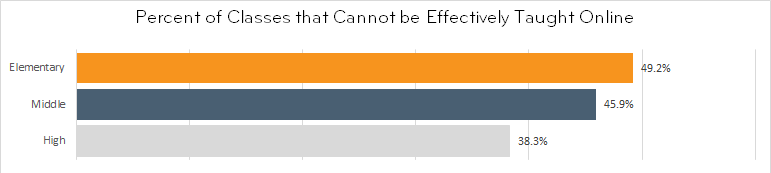

- Nearly 50 percent of classes cannot be effectively taught online in elementary school.

- Schools report student engagement has declined by more than 70 percent overall from the beginning to the end of the school year remote learning.

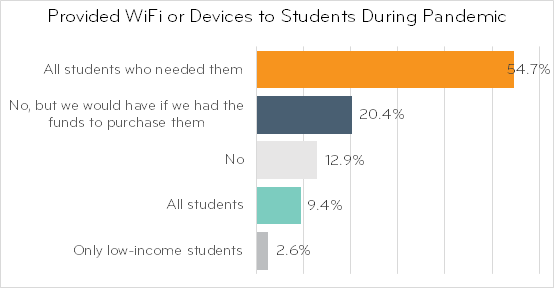

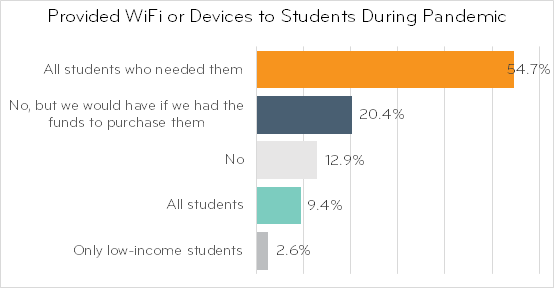

- More than two-thirds of partner schools provided remote learning devices or Wi-Fi access to all or students who needed them. Another 20 percent would have provided them if they had the funds to do so.

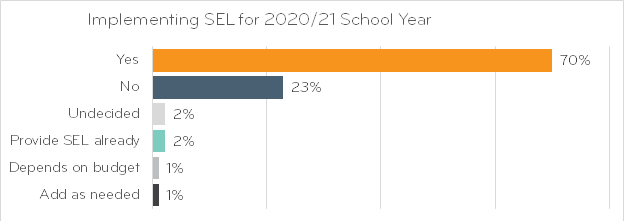

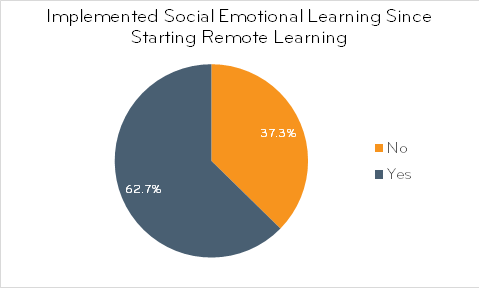

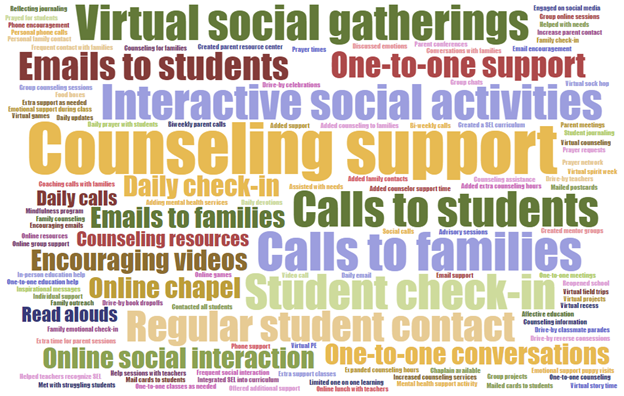

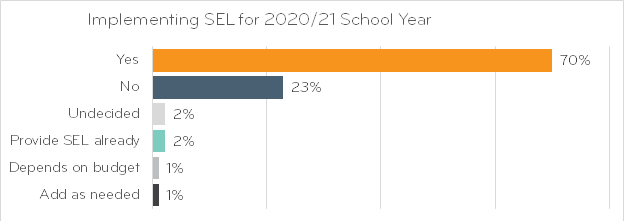

- Almost two-thirds of partner schools added social and emotional learning (SEL) and coping to aid their students and families. SEL will be continued by schools in the coming 2020/21 school year.

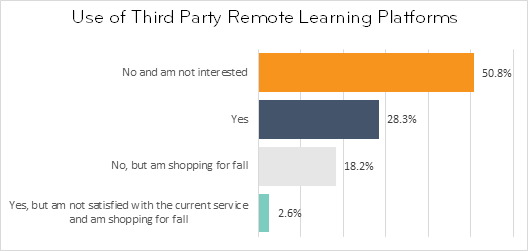

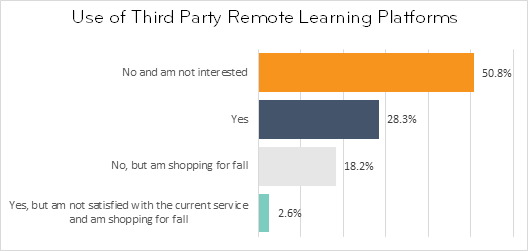

- Fifty percent of schools maintained direct student interaction via online platforms and did not want nor plan to outsource that to third party remote learning systems.

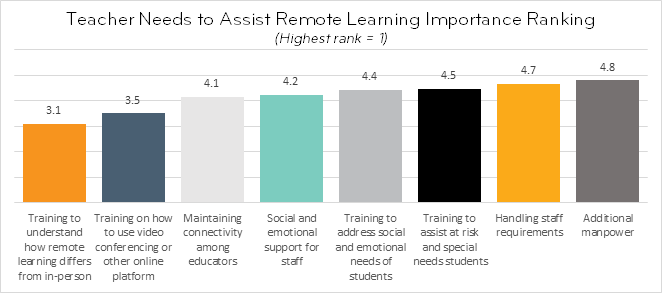

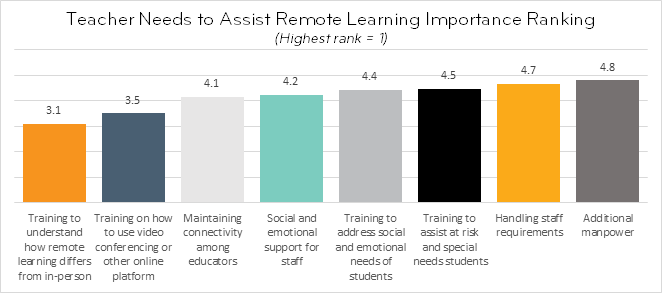

- The three highest priority needs for teachers are:

- training to understand how remote learning differs from in-person learning,

- remote learning technology training, i.e. video conferring and online lesson platforms,

- and maintaining connectivity among educators.

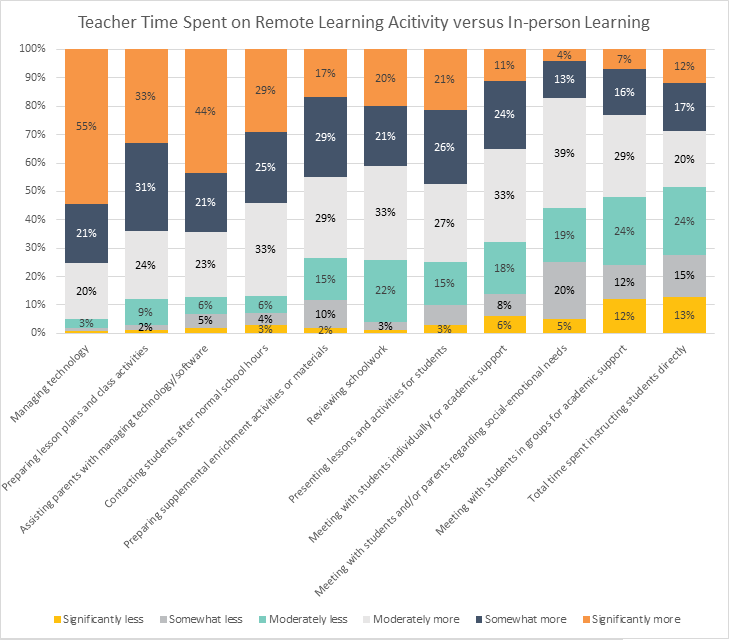

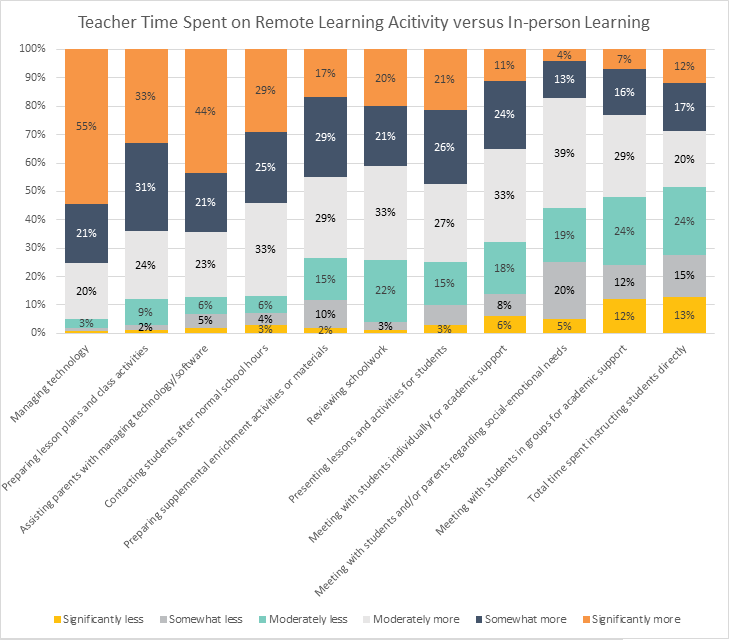

- Teachers are spending significantly more time:

- managing technology (96 percent),

- assisting parents with managing technology (88 percent),

- and contacting students after normal school hours (87 percent).

Key findings on remote learning loss or the ‘COVID slide’:

-

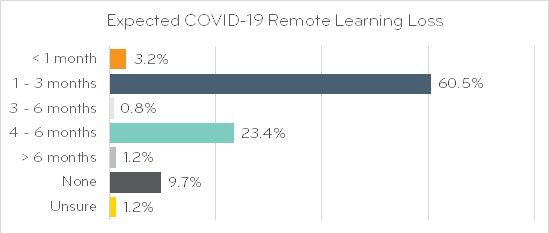

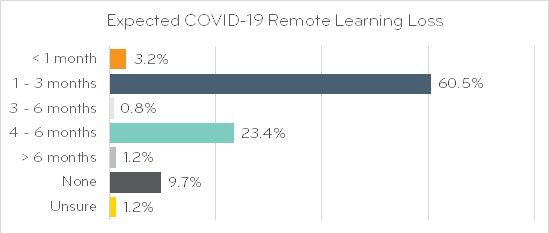

- More than 60 percent of schools estimate the loss to be one to three months.

- The median learning loss estimate is 2.5 months.

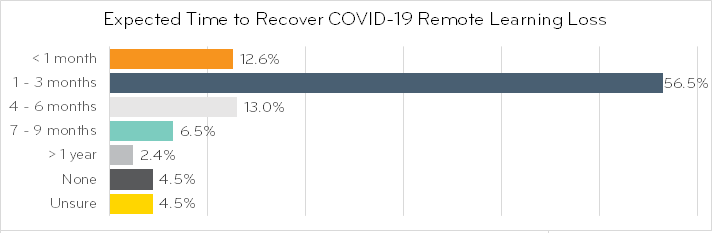

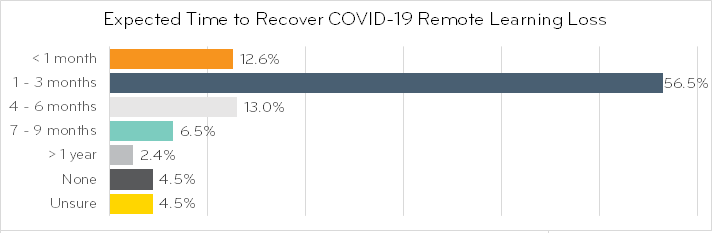

- Learning loss recovery is mixed:

- The median recovery of the learning loss is 2.8 months.

- 16 schools expect the learning loss recovery to take almost the entire school year.

- Six schools expect recovery to take multiple school years.

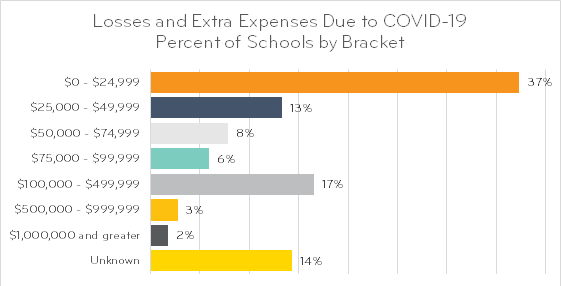

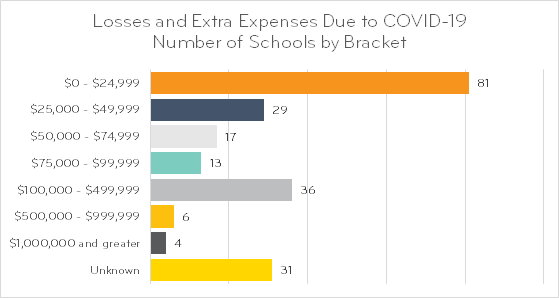

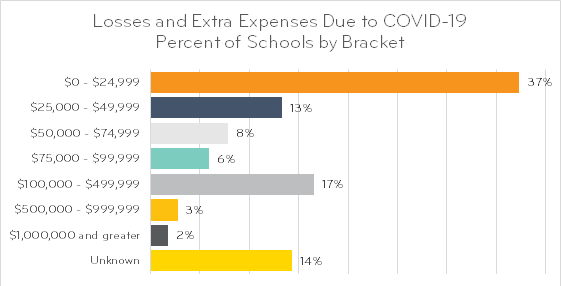

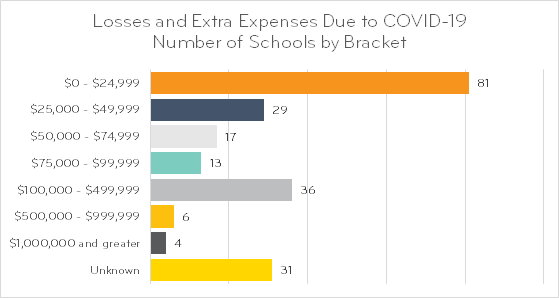

Key findings on COVID-19 related costs to schools (included tuition loss):

-

- The median cost to partner schools is $112, 617.

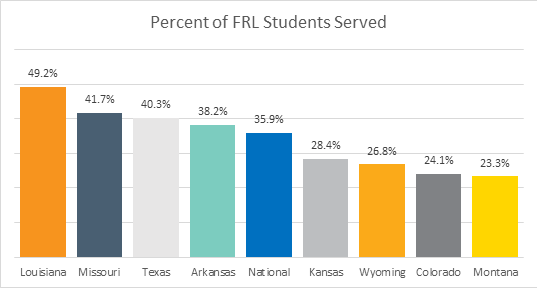

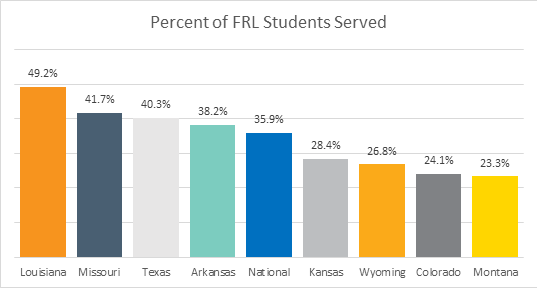

- ACE partner schools serve on average 36 percent of low-income students with a high of more than 49 percent in Louisiana and 23 percent in Montana.

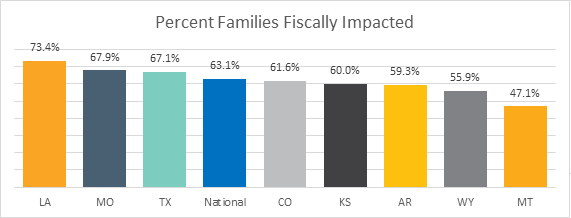

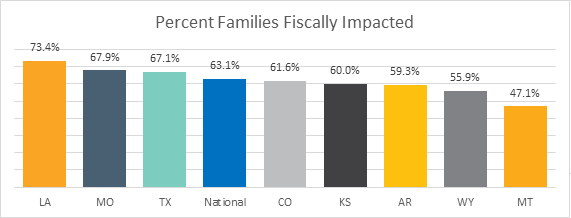

Key findings for families:

-

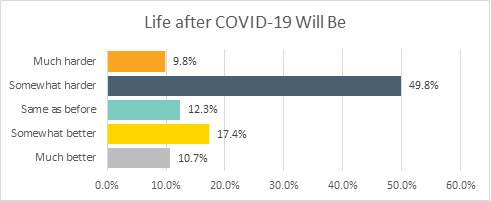

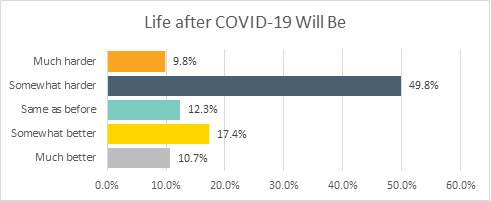

- Almost 60 percent of families believe life after COVID-19 will be somewhat or much harder.

- More than 63 percent of families suffered fiscal impact due to the shutdowns.

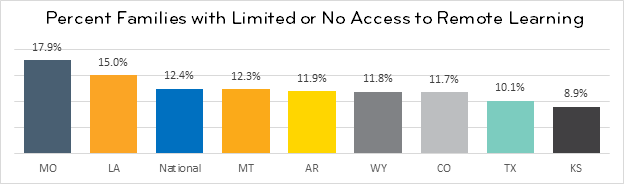

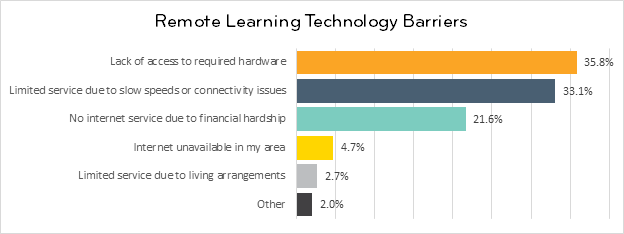

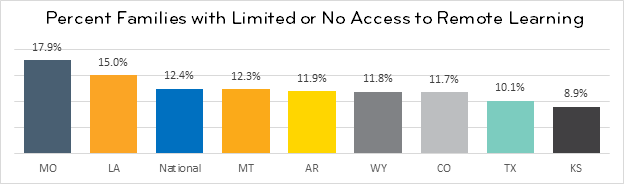

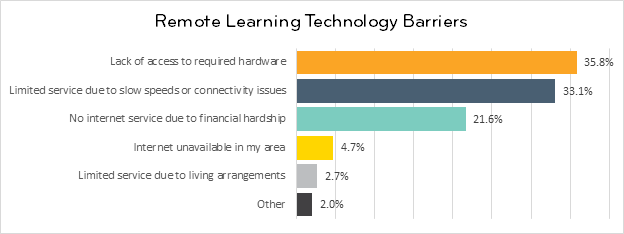

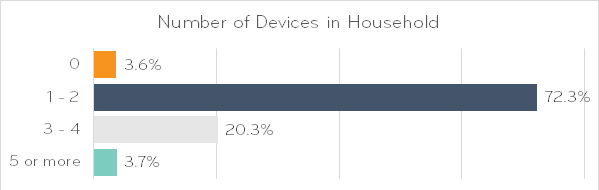

- More than 12 percent have no or limited access to remote learning technology. The highest technology barriers are:

- Limited or no high-speed internet access (62 percent)

- Lack of access to required hardware (36 percent)

Schools, parents, and students have concerns over remote learning versus in-person learning. The amount of course work that schools report cannot be taught effectively remotely is highest in elementary school and decreases into high school, i.e. the younger a child is the more direct and personal instruction they need.

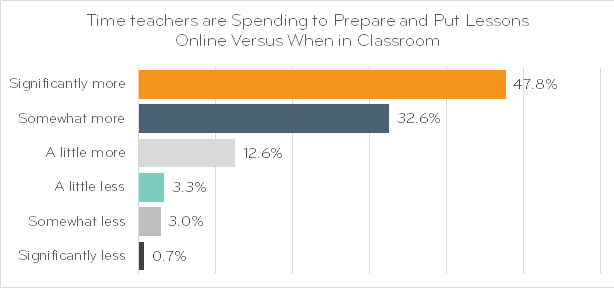

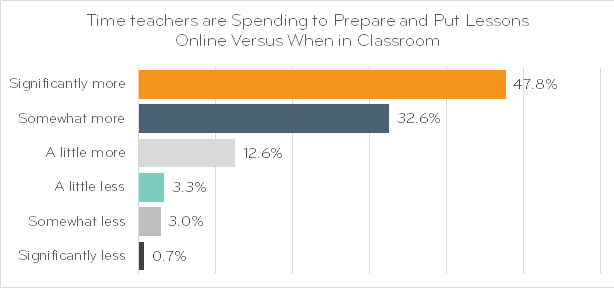

In addition to the classes that cannot be effectively taught online, teachers are spending more time preparing their lessons to put online. They are spending more time managing technology than before, while spending less time instructing students.

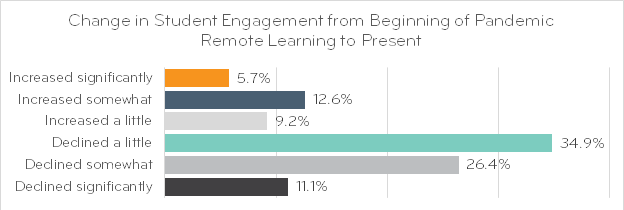

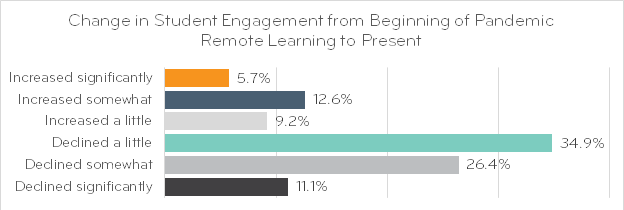

As the pandemic shutdown progressed, schools report student engagement decreased over time with almost 35 percent by a little, more than 26 percent somewhat, and 11 percent with a significant decline.

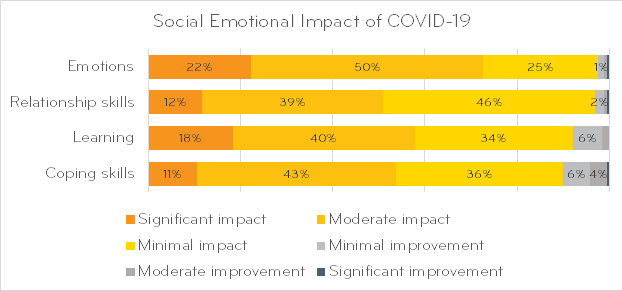

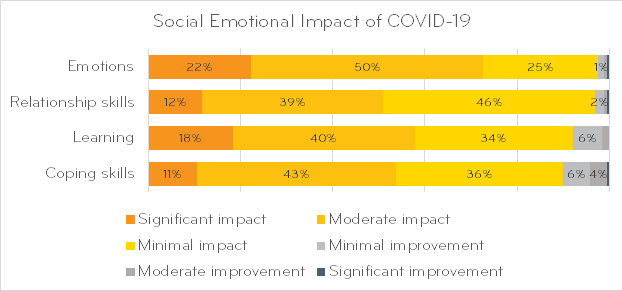

The social and emotional impact of the pandemic shutdown could have contributed to the decline in engagement since almost two-thirds of partner schools reported adding social and emotional learning (SEL) and coping to aid their students and families. These schools are planning on continuing and even adding more SEL this coming school year.

Besides the declining student engagement, many students had barriers to remote learning with the lack of laptops, iPads, etc. and the lack of reliable high-speed internet access.

Many schools did provide students with devices and WiFi if they could afford to do so.

Almost 51 percent of schools maintained direct student interaction via online platforms and did not want nor plan to outsource that to third party remote learning systems. Schools feel it is more important for many students to have direct instructional contact with their regular teachers instead of a third-party learning system.

The rapid transition to remote learning left many teachers scrambling. Schools rank their top two needs as training to understand how remote learning differs from in-person learning and training on how to use video conferencing and other online platforms.

Teachers are not immune to the social and emotional impacts of exclusive remote learning. Schools ranked the need to maintain teacher connectivity and social and emotional support for staff as the third and fourth greatest needs.

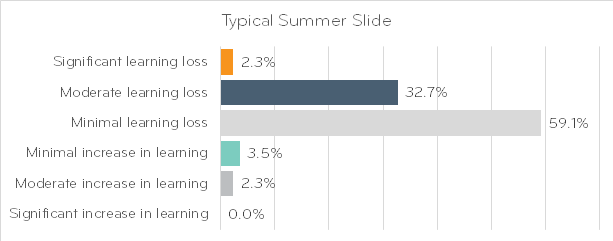

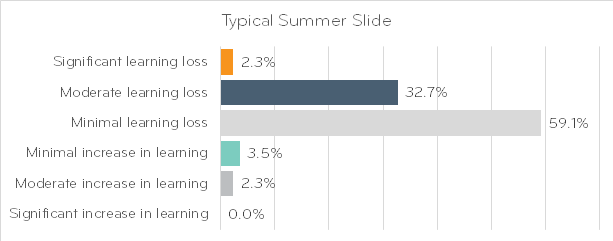

Another key element of the pandemic induced remote learning is what many are calling the “COVID slide”. To gage the impact on students at ACE partner schools, we asked about the typical summer slide, the COVID slide, and the time needed to recover the lost learning. This is what we found. There is minimal learning loss during the typical summer slide. The average learning loss due to the COVID slide is estimated at 2.5 months, with a recovery time of 2.8 months. Recovery time is very mixed with 16 schools expect the learning loss recovery to take almost the entire school year and six schools expect recovery to take multiple school years.

Private schools have taken a financial hit in conjunction with the learning loss. The median cost to partner schools is $112, 617. On average, these schools serve 36 percent of low-income students with a high of more than 49 percent in Louisiana and 23 percent in Montana.

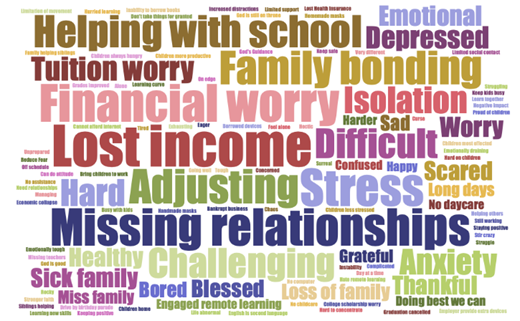

Families were also hit hard economically with loss of jobs, reduced hours, or the need to stay home due to their children’s school being shut down, and loss of loved ones.

This impact will be long-lasting according to the families. They shared their concern that life is not going to return to normal anytime soon with almost 60 percent saying life after COVID-19 will be somewhat or much harder.

ACE Scholarships Partner School Survey Questions and Results

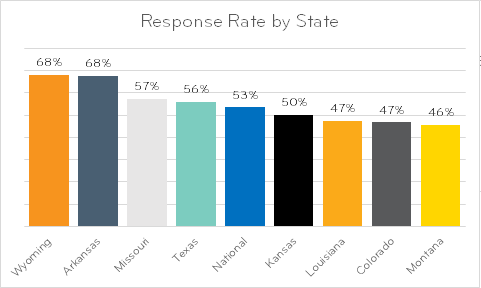

Surveys Emailed: 638

Survey Responses: 323

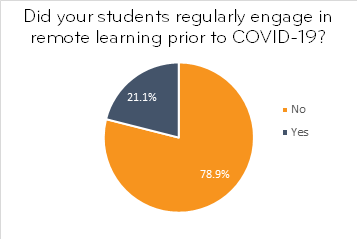

- Prior to the COVID-19 pandemic, did students at your school regularly engage in remote learning?

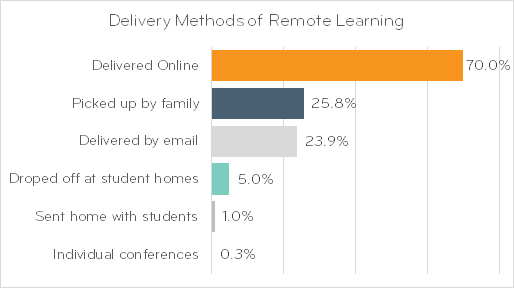

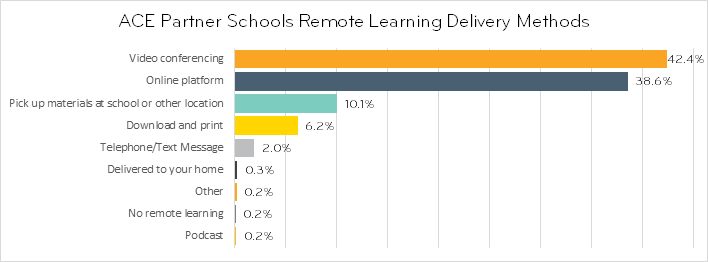

- How are remote learning lesson materials delivered to families?

- Did your school provide iPads, laptops, WiFi hotspots, ect. to students or families during the COVID-19 pandemic?

- Have you implemented any additional social and emotional support into the classroom during this period of remote learning?

- Please describe the additional social and emotional support you have implemented:

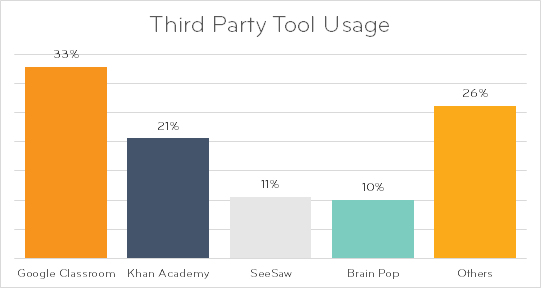

- Are you currently using any third party distance learning service?

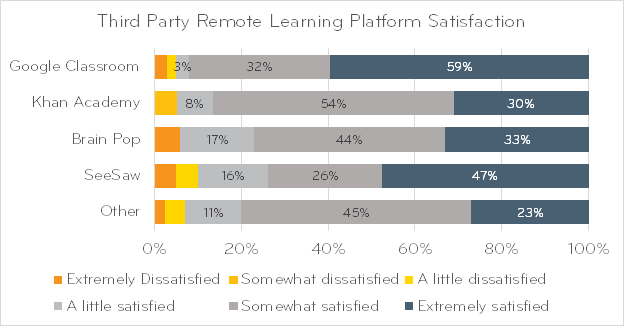

- Please rate your satisfaction level with your current distance learning service? [Only rate products that you currently use]

*Some schools use multiple platforms.

**Other platforms include those with single-digit usage and include: Abeka Academies, Alpha Omega, Apex Learning Virtual School, Bob Jones University, Class Dojo, Edgenuity, FlipGrid, FuelEd, Ignitia, Instructure, IXL, Jupiter Ed, K12 Academies, Lalilo, Lexia Learning, Mindspark Learning, Pearson Online Academy, Schoology, Typing.com, Veritas Learning Lab, Wittenberg Academy, Xtra Math

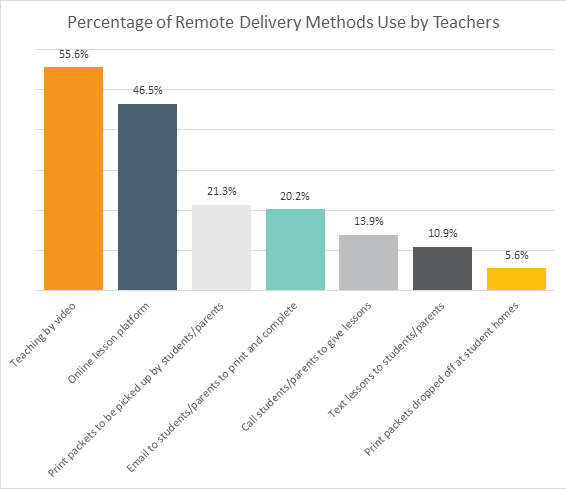

- What percentage of each remote learning delivery method are your teachers using?

- Please rank your staff needs to facilitate better remote learning? [Only rank the items your staff needs]

- Please rate the time your teachers are spending on each of the following aspects of teaching during the pandemic versus before the pandemic: [Only rate items your teachers are spending time on]

- How much time are your teachers spending to prepare and put their lessons online as compared to when they were in the classroom?

- What percentage of lessons cannot be effectively taught/performed online (labs, experiments, hands-on lessons, etc)?

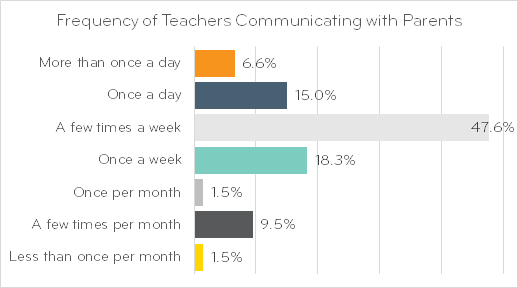

- How frequently are teachers communicating with parents?

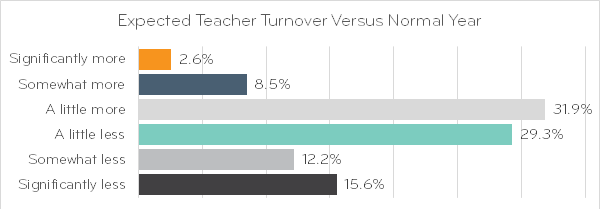

- What is your school’s expectation for teacher turnover in 2020-2021 as compared to a normal year?

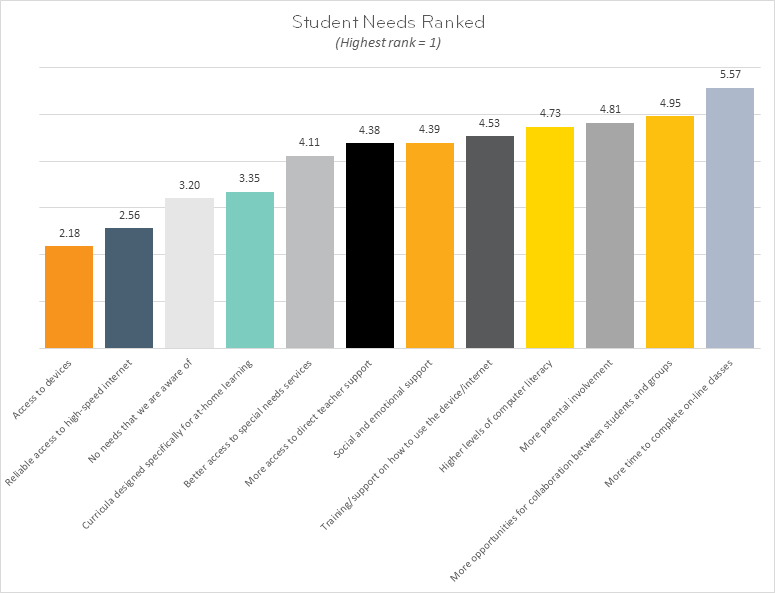

- What do your students need to succeed in a remote learning environment? [Only rank items your students’ need]

- How has student engagement changed from the first day of the pandemic remote learning to the present?

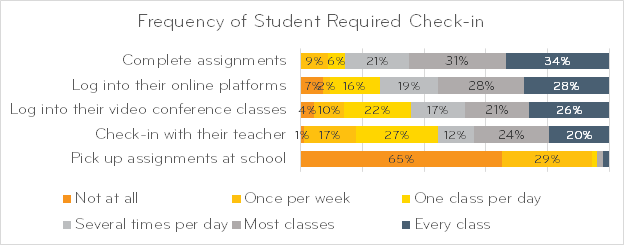

- How frequently are students required to _________?

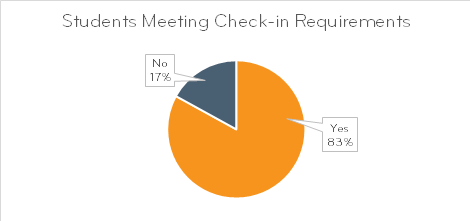

- How many students are meeting these class requirements?

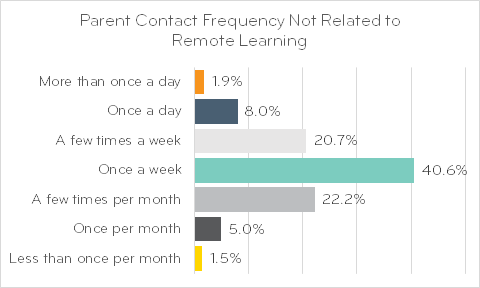

- How frequently has your school been communicating with parents for reasons other than remote learning during the pandemic?

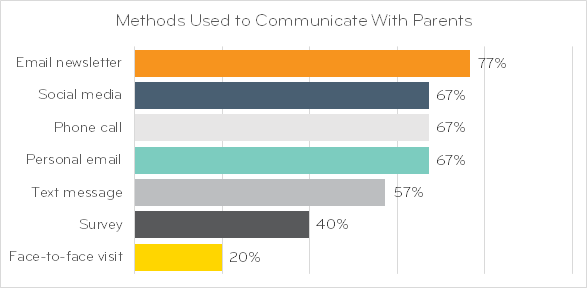

- What methods are you using to communicate with parents? [Check all that apply]

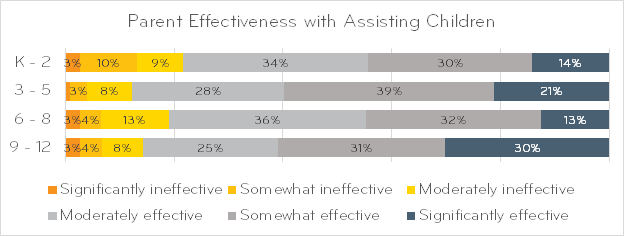

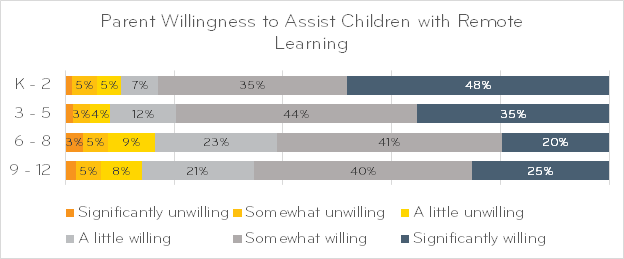

- How effective have parents been at assisting with at-home learning for the following grade levels? [Only rate grades that are applicable to your school]

- How willing have parents been to assist with at-home learning for the following grade levels? [Only rate grades that are applicable to your school]

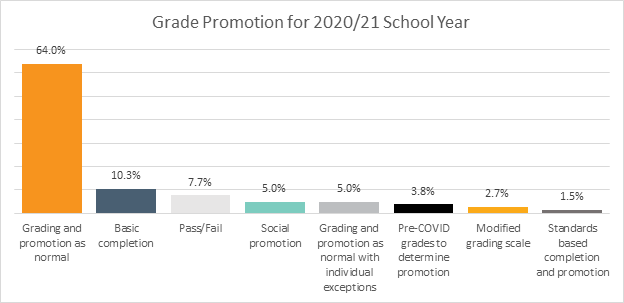

- Thinking about the 2019-20 school year, how are you handling grade promotion?

- Please estimate your expectation for student enrollment changes for your school for the 2020-21 school year?

This data is unusable. It showed an average of 39% increase with none saying any loss of students. They appeared to misunderstand the question.

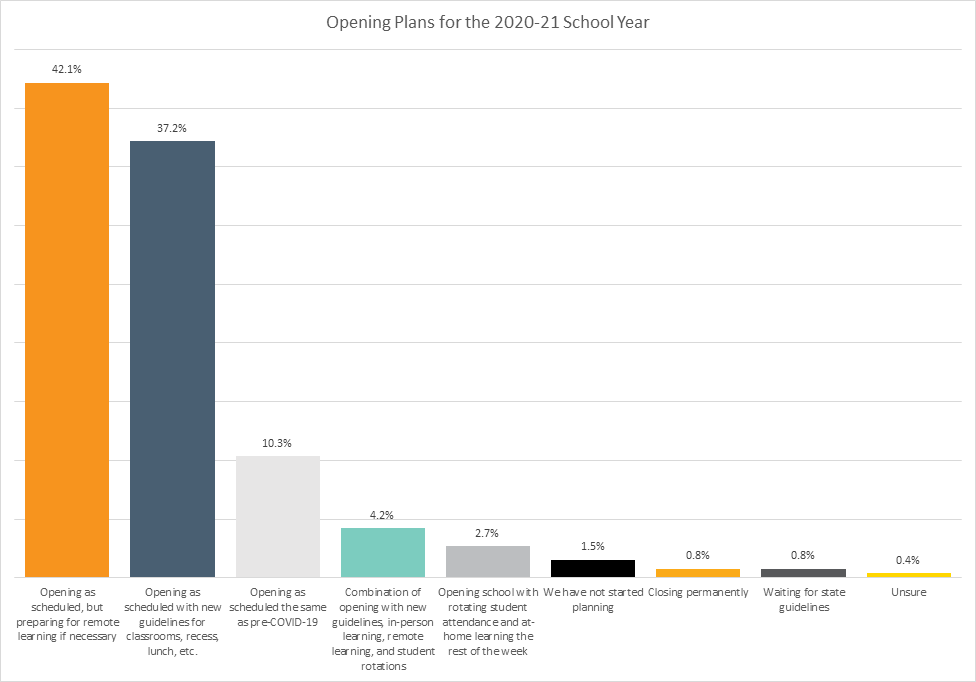

- What are your plans for your school for the 2020-21 school year?

- What is the main reason you are closing permanently?

Two schools responded and both said Loss of tuition revenue

- How would you rate the typical summer learning slide of your students?

- How many months of learning loss do you expect due to the impact of COVID-19 related issues?

Average expected learning loss due to remote learning due to COVID-19 is 2.5 months.

- How long do you believe it will take an average student at your school to recoup learning losses suffered during the pandemic?

Average time schools expect students to regain their education losses due to the COVID slide is 2.8 months. Sixteen schools expect learning recovery to take almost one entire school year and six schools expect it to take more than one school year.

- How would you rate the social and emotional impact of the COVID-19 crisis on your students?

- Will you be implementing any social and emotional support into the classroom for the 2020-21 school year?

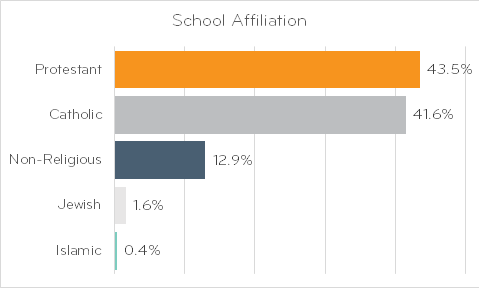

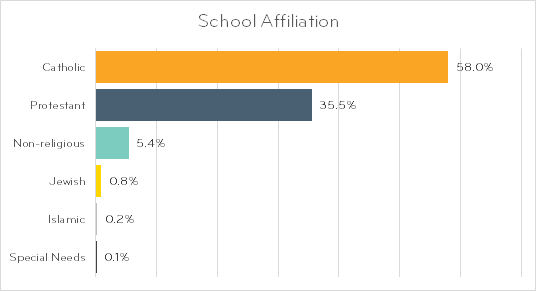

- School Affiliation

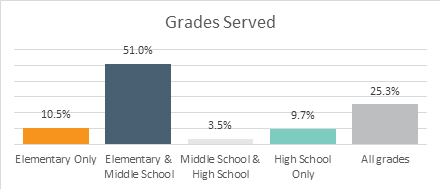

- Grade levels served [Check all that apply]

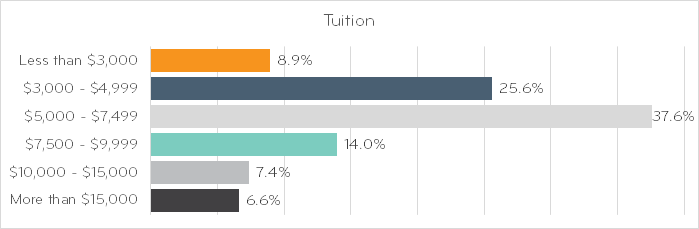

- Tuition

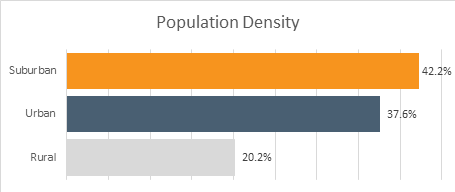

- Population Density

- Please indicate costs, and if possible, estimated amounts incurred by your school as a result of COVID-19. This can be a total sum or a list of items and their individual costs.

The average COVID-19 costs and loss of revenue for the schools that could identify their costs, the average is $112,617.

- What percentage of students does your school serve who meet the guidelines of the federal free and reduced-price lunch (FRL) program?

ACE Scholarships Family Survey Questions and Results

- Has your family been financially impacted through involuntary loss of job or unpaid leave?

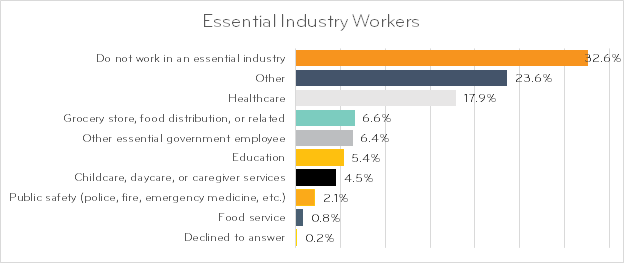

- Do you work in an essential industry?

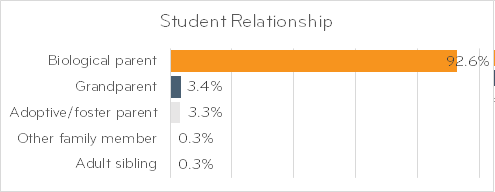

- How would you describe your relationship to the children living in your house?

- Do you have access to the technology needed to accommodate remote learning for your children (high-speed internet, computer availability, etc.)?

- What is the primary barrier to remote learning?

- How many devices (computers, tablets, etc.) in your home are available or readily accessible for remote learning?

- How does your child’s school deliver its remote-learning lessons?

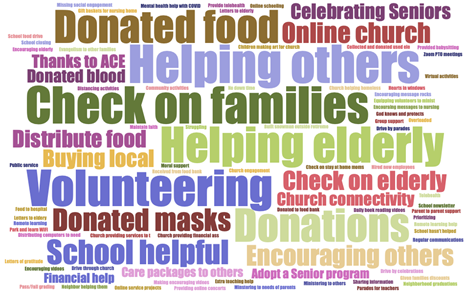

- How have COVID-19 and the related closures affected your life, family situation, and learning experience for your children? (Please describe in the box below)

- After the COVID-19 crisis, life will be:

- Have you or your school undertaken any efforts to serve your community during this time of crisis? (Please describe these efforts in the box below)

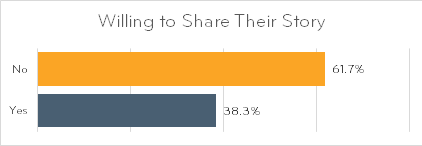

- Would you be willing to share your family’s story on the impact of the ACE scholarship received? (Interview for written story, video recording, etc.)

- School Affiliation

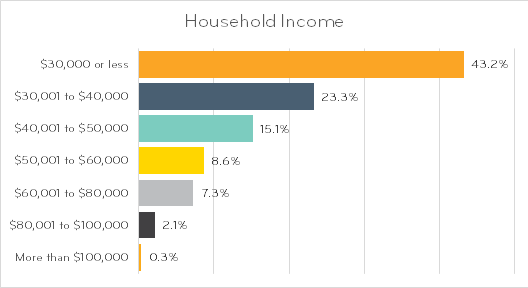

- Household Income

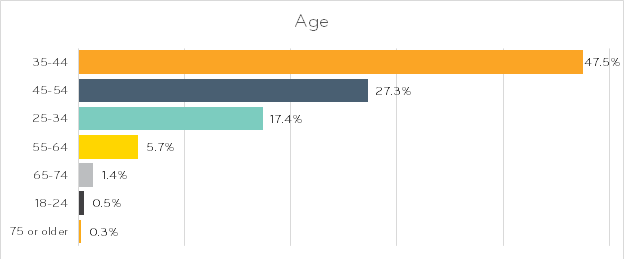

- Age

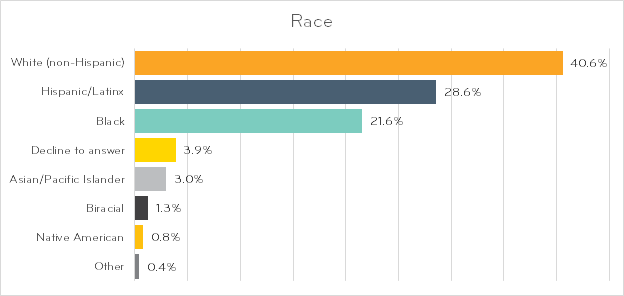

- Race

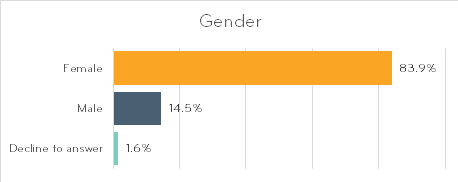

- Gender