Back in August, the IRS issued a proposed rule on federal charitable contribution deductions under state tax credit programs. For a refresher on this rule and its implications, see our previous post on the topic. For those just tuning in, the short version is that the IRS is considering a regulatory change that would forbid donors from receiving both a state tax credit and a federal charitable contribution deduction for the same gift.

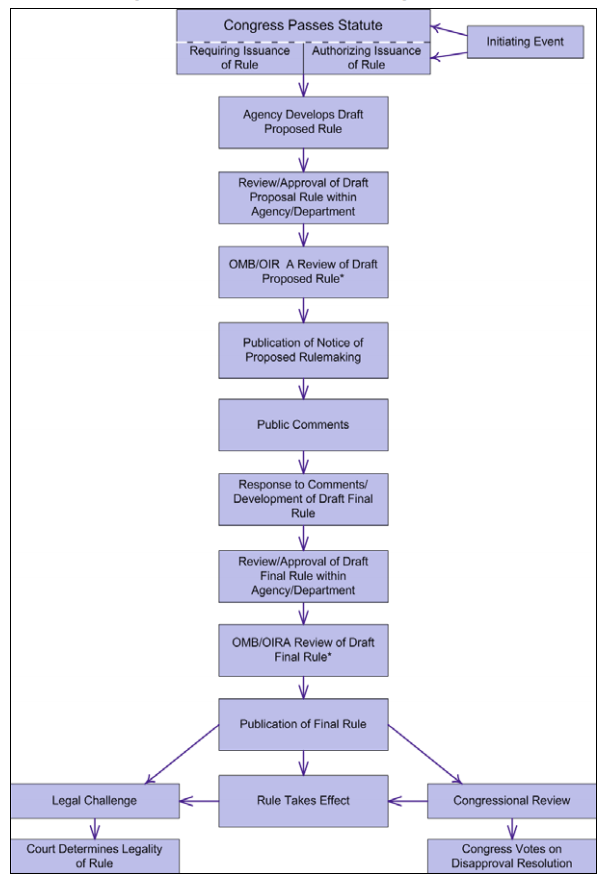

The federal rulemaking process is a complicated one, as you can see below. The process for this rule has been slightly different because of a special agreement reached between the White House Office of Management and Budget and the Department of the Treasury regarding the implementation of the Tax Cuts and Jobs Act.

The public comment period (about halfway down the chart) on the proposed rule officially ended earlier this month. All told, nearly 8,000 individuals and organizations submitted comments on the rule. Unfortunately, many of these comments were submitted by opponents of parental choice in education—opponents who are thrilled at the prospect that the proposed rule could damage longstanding scholarship tax credit programs.

The negative comments tended to follow a template that offered little in the way of practical input. Instead, they thanked the IRS for the “ending of a tax shelter that allows taxpayers to turn a profit when they fund private schools through state tuition tax credit programs.” While there is a valid argument to be made that donors should not be able to “profit” from charitable contributions, these folks fail to mention that the scholarship programs they are targeting serve nearly 300,000 students nationwide.

Opponents were not the only ones who showed up to make their voices heard. Dozens of organizations and hundreds of individuals who support or benefit from scholarship programs submitted their own comments. Many of these comments criticized the IRS for failing to distinguish private charities from government-run workaround entities. Others offered substantive suggestions on how to avoid harming disadvantaged scholarship students as the rule moves forward.

ACE worked with its partner schools and scholarship families in Kansas and Louisiana to submit hundreds of comments asking the agency to consider ways to mitigate negative impacts on scholarship students. ACE also submitted a more detailed comment to the IRS making the following points:

- Because the problem the IRS is seeking to address were created by federal legislation, allowing Congress to address the issue may be more appropriate (and effective) than a blanket regulatory solution.

- The IRS should consider a phased implementation that would minimize shocks to existing scholarship programs.

- If a phased implementation is not possible, the IRS should at the very least delay the rule’s effective date.

The IRS is currently reviewing comments on the rule, and will hear direct testimony on the issue at a Nov. 5 hearing in Washington, D.C. After that, the agency will begin revising the rule into its final form before another round of review. ACE will continue watching the process closely as the rule moves toward finalization.